Home

chiefjudgesmith.com

(Under construction)

This accounting fraud is protected. The public is not.

This accounting fraud is protected. The public is not. In 25 years not one person has attempted to stop them from using our innocent sister or has attempted to expose their accounting. Their signature cover is to use a trusting family member to unwitting carry out their agenda of dividing, destabilizing, and disempowering, the family they victimize. Going right for the jugular under the guise of a fiduciary relationship appears to be the perfect cover. Secrecy is essential to the fraudsters and fatal to the family.

$518,903 disappears

Complaint (See items 29-33)

COMES NOW the Plaintiff, Jean Mary O'Connell Nader, by counsel, and brings this

action pursuant to § 26-48 and 55-547.06 of the Code of Virginia (1950, as amended) for the removal and appointment of a trustee, and in support thereof states the following.

Parties and Jurisdiction

1. Plaintiff Jean Mary O’Connell Nader ("Jean") and *Defendants Anthony Miner

O’Connell ("Anthony") and Sheila Ann O'Connell ("Sheila") are the children of Harold A. O’Connell ("Mr. O’Connell"), who died in 1975, and Jean M. O'Connell ("Mrs. O'Connell"), who died on September 15, 1991.

2. The trusts that are the subject of this action are: (a) the trust created under the Last Will and Testament of Harold A. O'Connell dated April 11, 1974, and admitted to probate in this Court on June 18, 1975; and (b) a Land Trust Agreement dated October 16, 1992, which was recorded among the land records of this Court in Deed Book 8845 at Page 1449.

3. Jean, Sheila, and Anthony are the beneficiaries of both of the trusts and, therefore, are the parties interested in this proceeding.

Facts

4. During their lifetimes, Mr. and Mrs. O'Connell owned as *tenants in common a

parcel of unimproved real estate identified by Tax Map No. 0904-0 1-00 17 and located near the Franconia area of Fairfax County, Virginia and consisting of approximately 15 acres (the "Property").

5. After his death in 1975, a 46.0994% interest in the Property deriving fiom Mr,

O'Connell's original 50% share was transferred to a trust created under his Last Will and Testament (the "Harold Trust"), of which Anthony serves as trustee. A copy of the Last Will and Testament of Harold A. O'Connell is attached hereto as Exhibit A.

6. Mrs. O'Connell held a life interest in the Harold Trust and, upon her death in

1991, the trust assets were to be distributed in equal shares to Jean, Sheila, and Anthony as remainder beneficiaries. Although other assets of the Harold Trust were distributed to the remainder beneficiaries, the trust's 46.0994% interest in the Property has never been distributed to Jean, Sheila, and Anthony in accordance with the terms of the Harold Trust.

7. After Mrs. O'Connell's death, her 53.9006% interest in the Property passed to

Jean, Sheila, and Anthony in equal shares, pursuant to the terms of her Last Will and Testament and Codicil thereto, which was admitted to probate in this Court on December 10, 1991.

8. Thus, after Mrs. O'Connell's death, Jean, Sheila, and Anthony each owned a

17.96687% interest in the Property, and the Harold Trust continued to own a 49.0994% interest in the Property.

9. By a Land Trust Agreement dated October 16, 1992, Jean, Sheila, and Anthony,

individually and in his capacity as trustee of the Harold Trust, created a Land Trust (the "Land Trust"), naming Anthony as initial trustee. A copy of the Land Trust Agreement is attached hereto as Exhibit B and incorporated by reference herein. The Harold Trust, Jean, Sheila, and Anthony (individually) are the beneficiaries of the Land Trust.

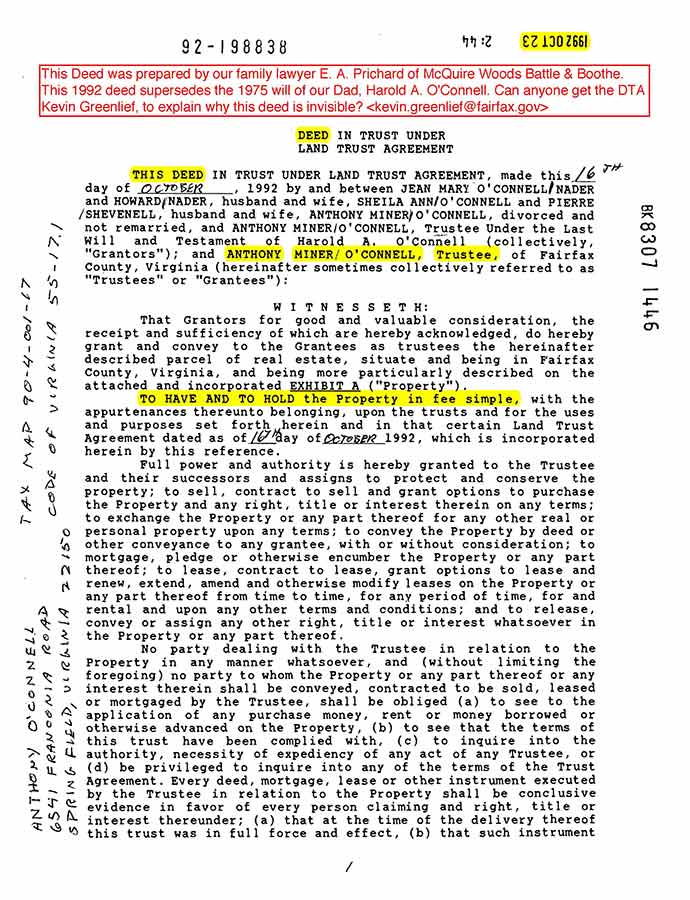

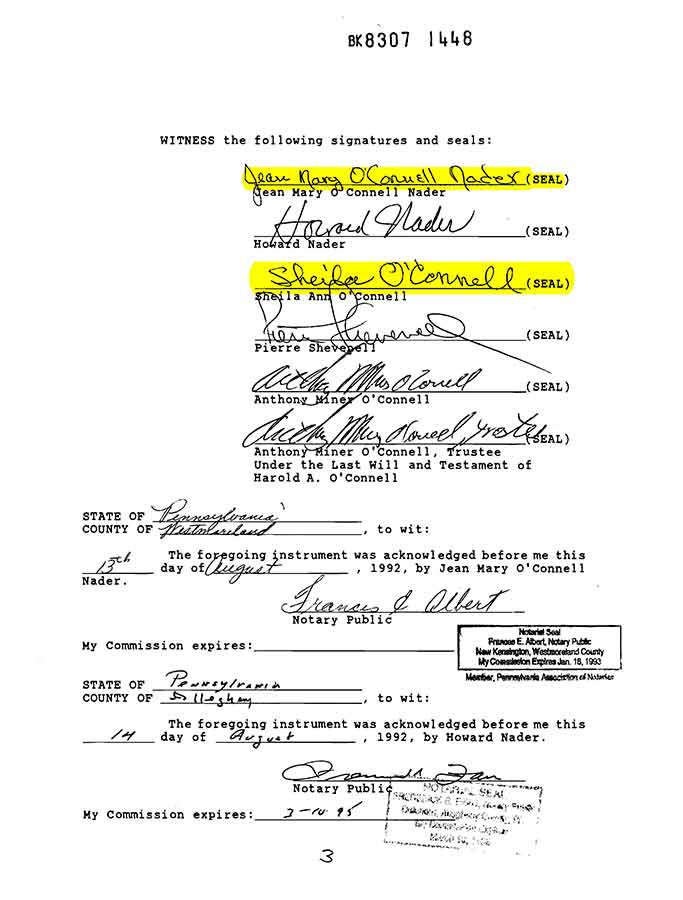

10. The Property was thereafter conveyed by Jean, Sheila, and Anthony, individually

and as trustee of the Harold Trust, to Anthony, as trustee of the Land Trust, by a Deed dated October 16,1992 and recorded on October 23,1992 in Deed Book 8307 at Page 1446 among the land records for Fairfax County.

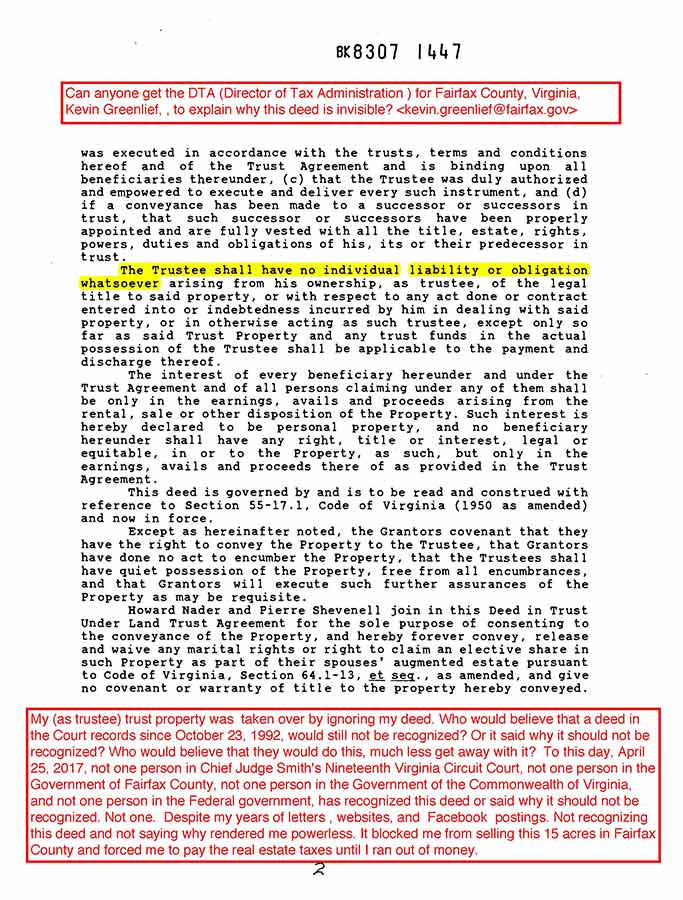

11. As trustee under the Land Trust, Anthony was granted broad powers and

responsibilities in connection with the Property, including the authority and obligation to sell the Property. Paragraph 4.04 of the Land Trust Agreement states, in part, as follows:

If the Property or any part thereof remains in this trust at the expiration of twenty (20) years from date hereof, the Trustee shall promptly sell the Property at a public sale after a reasonable public advertisement and reasonable notice thereof to the Beneficiaries.

12. To date, the Property has not been sold, and the Land Trust is due to expire on

October 16,2012.

13. According to Paragraph 9.03 of the Land Trust Agreement, the responsibility for

payment of all real estate taxes on the Property is to be shared proportionately by the

beneficiaries. However, if a beneficiary does not pay his or her share, the Land Trust Agreement provides:

The Trustee will pay the shortfall and shall be reimbursed the principal plus 10% interest per annum. Trustee shall be reimbursed for any outstanding real estate tax shares or other Beneficiary shared expense still owed by any Beneficiary at settlement on the eventual sale of the property.

14. For many years, Jean sent payment to Anthony for her share of the real estate

taxes on the Property. Beginning in or about 1999, Anthony refused to accept her checks because they were made payable to "County of Fairfax." Anthony insisted that any checks for the real estat'k taxes be made payable to him individually, and he has returned or refused to forward Jean's checks to Fairfax County. Under the circumstances, Jean is unwilling to comply with Anthony's demands regarding the tax payments.

15. Anthony is not willing or has determined he is unable to sell the Property due to a

mistaken interpretation of events and transactions concerning the Property and, upon information and belief, the administration of his mother's estate. Anthony's position remains intractable, despite court rulings against him, professional advice, and independent evidence. As a result, Anthony is unable to effectively deal with third parties and the other beneficiaries of the Land Trust.

16. In 2007, Anthony received a reasonable offer from a potential buyer to purchase

the Property. Upon information and belief, Anthony became convinced of a title defect with the Property that, in his opinion, was an impediment to the sale of the Property. A title commitment issued by Stewart Title and Escrow on April 24,2007, attached hereto as Exhibit C, did not persuade Anthony that he, as the trustee of the Land Trust, had the power to convey the Property. Because of this and other difficulties created by Anthony, the Property was not sold.

17. Since 2007, it appears the only effort put forth by Anthony to sell the Property has

been to post it for sale on a website he created, http://www.alexandriavirginial5acres.com

18. Since 2009, Anthony has failed to pay the real estate taxes for the Property as

required by the Lhd Trust Agreement. Currently, the amount of real estate tax owed, including interest and penalties, is approximately $27,738.00.

19. Anthony has stated that he purposely did not pay the real estate taxes in order to

force a sale of the Property and clear up the alleged title defects.

20. Since the real estate taxes are more than two years delinquent, Anthony's failure

to pay may result in a tax sale of the Property. Anthony was notified of this possibility by a notice dated October 26, 201 1, attached hereto as Exhibit D. In addition to the threatened tax sale, the Land Trust is incurring additional costs, including penalties, interest, and fees, that would not be owed if Anthony had paid the real estate taxes in a timely manner.

21. In May 20 12, Jean, through her counsel, wrote a letter to Anthony requesting that

he cooperate with a plan to sell the Property or resign as trustee. To date, Anthony has not expressed a willingness to do either, and still maintains that the alleged title defect and other "entanglements" must be resolved before any action can be taken towards a sale of the Property.

Count I: Removal of Anthony O'Connell as Trustee of Land Trust

22: The allegations of paragraphs 1 through 21 are incorporated by reference as if

fully stated herein.

23. As trustee of the Land Trust, Anthony has a fiduciary duty to comply with the

terms of the trust agreement, to preserve and protect the trust assets, and to exercise reasonable care, skill, and caution in the administration of the trust assets.

24. Anthony has breached his fiduciary duties by his unreasonable, misguided, and imprudent actions, including but not limited to, his failure to sell the Property and non-payment of the real estate taxes on the Property.

25. The breaches of duty by Anthony constitute good cause for his removal as trustee

of the Land Trust.

WHEREFORE, Plaintiff Jean Mary O'Connell Nader prays for the following relief:

A. That the Court remove Anthony Minor O'Connell as trustee under the Land Trust

Agreement dated October 16, 1992, pursuant to 26-48 of the Code of Virginia

(1950, as amended);

B. That all fees payable to Anthony Minor O'Connell under the terms of the

aforesaid Land Trust Agreement, including but not limited to, the trustee's

compensation under paragraph 9.01, and all interest on advancements by the

trustee to the trust for payment of real estate taxes pursuant to paragraph 9.03, be

disallowed and deemed forfeited;

C. That all costs incurred by Plaintiff Jean Mary O'Connell Nader in this action,

including reasonable attorneys' fees, be paid by the Land Trust; and

D. For all such further relief as this Court deems reasonable and proper.

Count 11: Removal of Anthony O'Connell as Trustee of the Trust under the Will of Harold A. O'Connell

26. The allegations of paragraphs 1 through 25 are incorporated by reference as if

fully stated herein.

27. The terms of the Harold Trust provide that, upon the death of Mrs. O'Connell, the

assets are to be distributed to Jean, Sheila, and Anthony in equal shares. Notwithstanding the terms of the Harold Trust and the provisions for its termination, Anthony entered into the Land

Trust Agreement in his capacity as trustee of the Harold Trust. As a result, upon the sale of the

Property, Anthony can exercise greater control over the Harold Trust's share of the sale proceeds

than if the parties held their beneficial interests in their individual capacities.

28, Other than its status as beneficiary of the Land Trust, there is no reason for the

continuation of the Harold Trust.

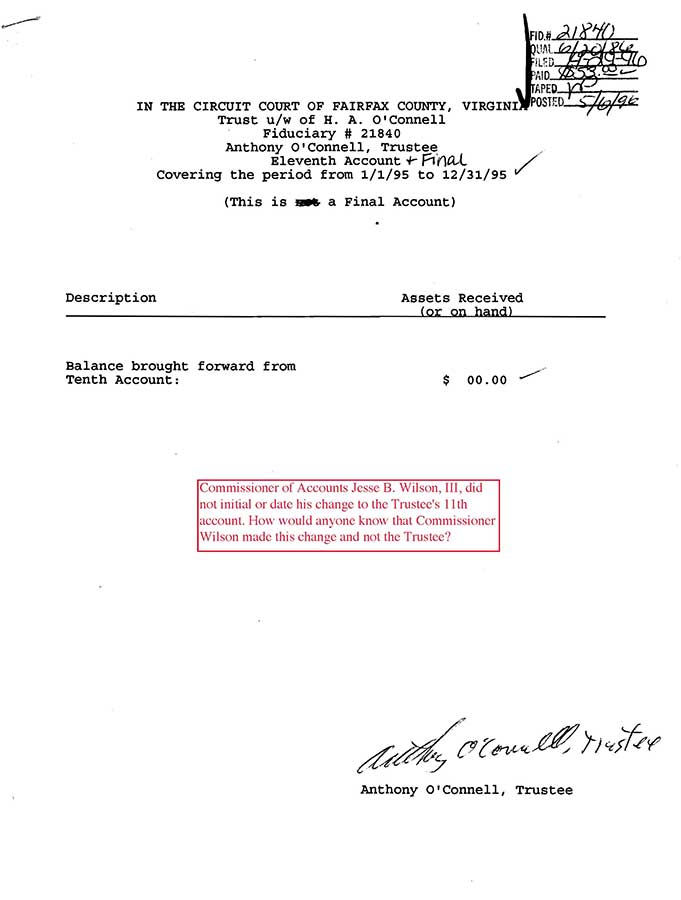

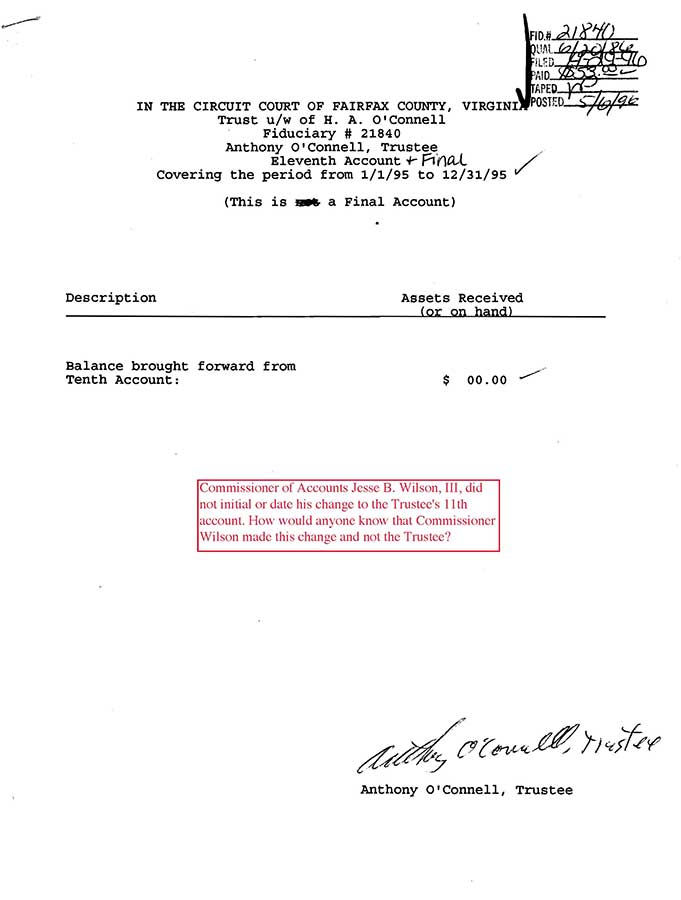

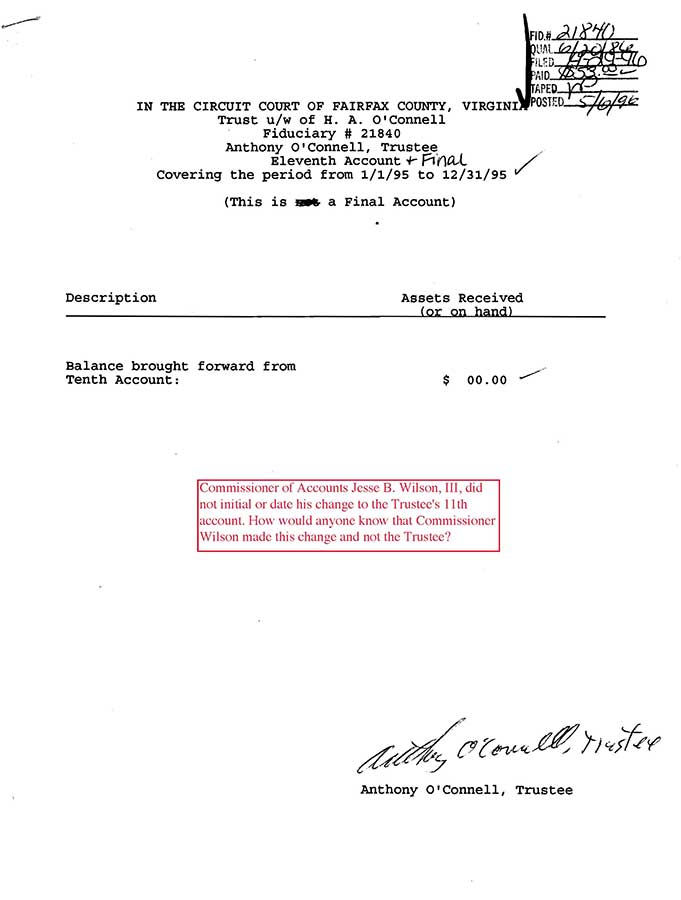

29. On August 8, 2000, an Eleventh Account for the Harold Trust was approved by the Commissioner of Accounts for the Circuit Court of Fairfax County and determined to be a final account.

30. Anthony repeatedly and unsuccessfully challenged the Commissioner's determination and requested, inter alia, that the Court and the Commissioner of Accounts investigate a debt of $659.97 that he alleged was owed to the Harold Trust by Mrs. O'Connell's estate. In these proceedings, the Commissioner stated, and the court agreed, that there was no evidence to support Anthony's claims that a debt existed and, if so, that it was an asset of the Harold Trust.

31. Anthony's repeated and unsuccessful challenges to the rulings of the

Commissioner of Accounts and the Circuit Court in connection with the Eleventh Account, and his persistence in pursuing his unfounded claims to the present day, demonstrate that he is unable to administer the Harold Trust effectively and reliably.

32. It is in the best interests of the beneficiaries of the Harold Trust that, upon the sale

of the Property, the net sale proceeds be distributed in an orderly and expedient manner. Based on Anthony's actions, he is not the proper individual to fulfill the trustee's duties in administering the Harold Trust.

33. The removal of Anthony as trustee best serves the interests of the beneficiaries of the Harold Trust.

WHEREFORE, Plaintiff Jean Mary O'Connell Nader prays for the following relief:

A. That the Court remove Anthony Minor O'Connell as trustee under the Last Will

and Testament of Harold A. O'Connell, pursuant to § 55-547.06 of the Code of

Virginia (1 950, as amended);

B. That all costs incurred by Plaintiff Jean Mary O'Comell Nader in this action

including reasonable attorneys' fees, be awarded to her in accordance with § 55- 550.04 of the Code of Virginia (1950, as amended); and

C. For all such further relief as this Court deems reasonable and proper.

Count 111: Appointment of Successor Trustee

34. The allegations of paragraphs 1 through 33 are incorporated by reference as if

fully stated herein.

35. Jean is a proper person to serve as trustee of the Land Trust in order to sell the

Property on behalf of the beneficiaries of the Land Trust, and she is willing and able to serve in such capacity.

36. The best interests of the beneficiaries would be served if the Land Trust is continued for a sufficient period of time to allow the successor trustee to sell the Property, rather than allowing the Land Trust to terminate on the date specified in the Land Trust Agreement. Each of the individual beneficiaries of the Land Trust is age 70 or above, and it would be prudent to sell the Property during their lifetimes, if possible, rather than leaving the matter for the next generation to resolve.

37. Jean is a proper person to serve as trustee of the trust created under the Last Will

and Testament of Harold A. O'Connell, and she is willing and able to serve in such capacity.

WHEREFORE, Plaintiff Jean Mary O'Connell Nader prays for the following relief:

A. That Plaintiff Jean Mary O'Connell Nader be appointed as successor trustee under

the aforesaid Land Trust Agreement, with the direction to sell the Property upon

such terms and conditions as this Court deems reasonable and appropriate,

including, but not limited to, fixing a reasonable amount as compensation of the

successor trustee for her services;

B. That the term of the Land Trust be continued for a reasonable time in order to

allow for the sale of the Property;

C. That Plaintiff Jean Mary O'Connell Nader be appointed as successor trustee under

the Last Will and Testament of Harold A. O'Connell for all purposes, including

distribution of the net proceeds of the sale of the Property that are payable to such

trust;

D. That all costs incurred by Plaintiff Jean Mary O'Connell Nader in this action,

including reasonable attorneys' fees, be paid by the Land Trust; and

E. For all such further relief as this Court deems reasonable and proper.

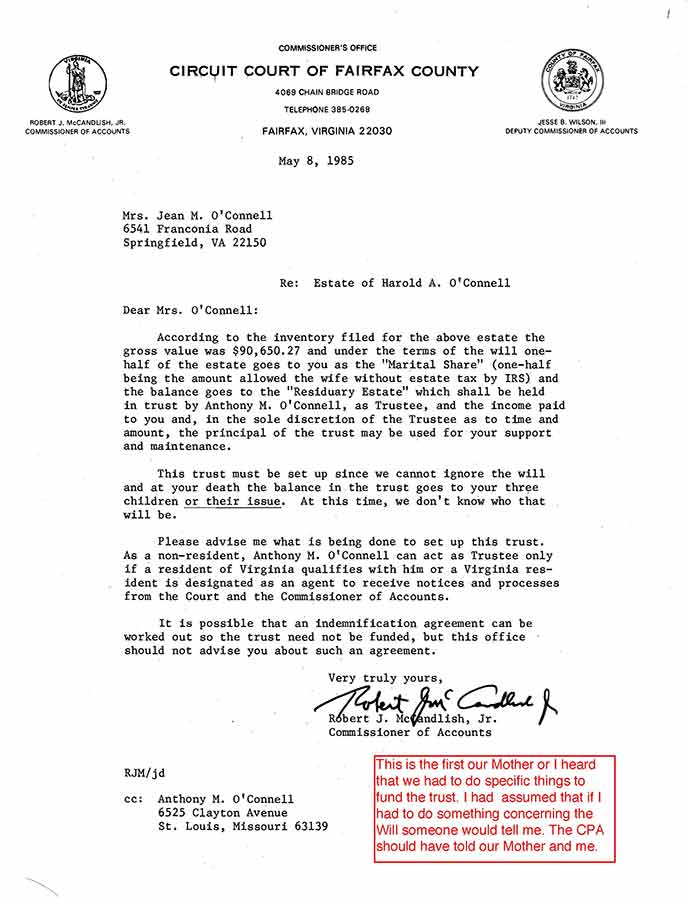

INSERT 11 th

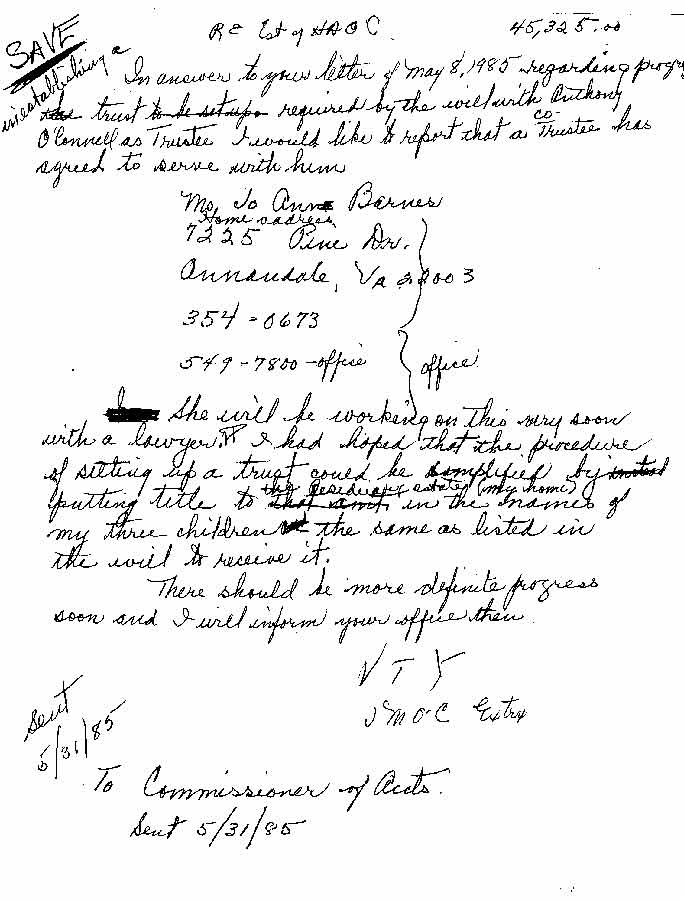

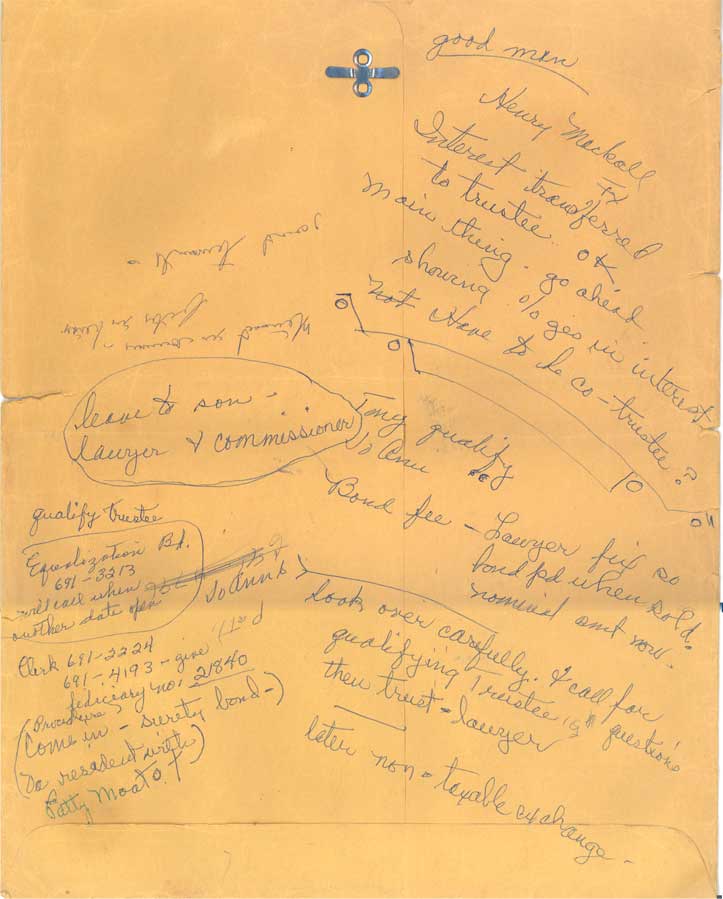

1999.08.09 Anthony O'Connell to Jesse Wilson and Henry Mackall

(The Trust's Twelfth Court Account, covering the period from 1996.1.1 to 1996.12.31)

"A check for $63.00 is enclosed to file this Twelfth Account. This is not a Final Account.

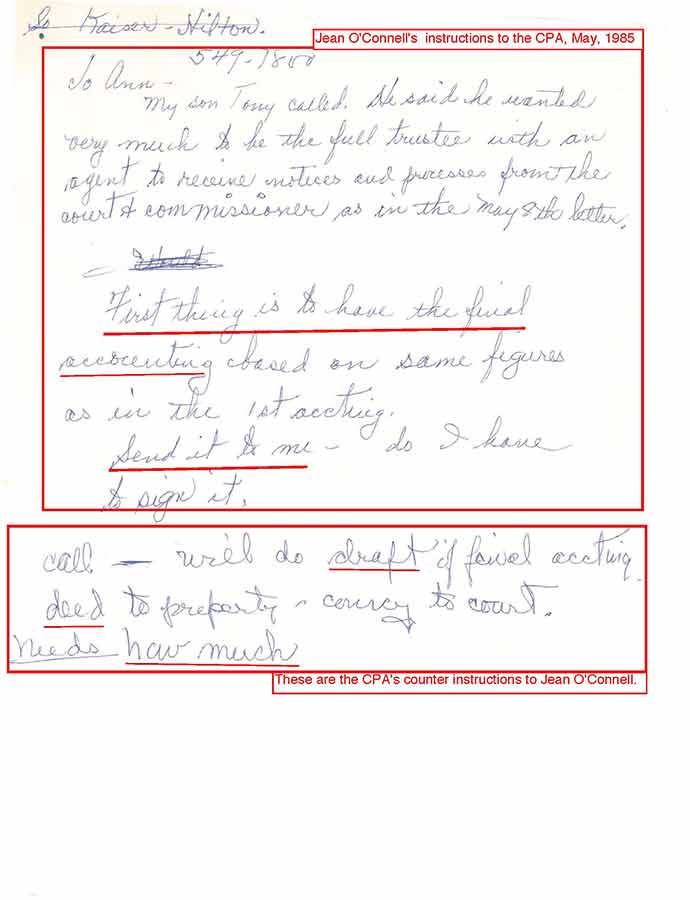

The accounting for the Trust u/w of H. A. O'Connell was entangled with the accounting of the Estate of Jean M. O'Connell, fiduciary # 49160, by the CPA (firm) I hired and by the lawyer who is co-executor for the Estate:

Ms. Jo Anne Barnes, CPA (firm).

Bruner, Kane & McCarthy, Limited

700 North Fairfax

Alexandria, Virginia 22313

Mr. Edward White, Attorney and Co-Executor

P.0. Box 207

Kinsale, Virginia 22488 (Last known address)

Those who control the entanglements control the people and assets that are entangled. I have experienced the CPA-lawyer entanglements before and know it would be foolhardy to try to sell Accotink (my family's remaining real estate, B8845 p1444 and B8307 p1446) until all the entanglements are removed and the accountings are clear.

To keep this Twelth Account simple and clear I will only address one of the known entanglements. In short, the CPA (firm) did the Trust's Seventh Court Account in a manner that required me to pay the Estate $ 1,475.97. The lawyer discovers that this is $659.97 too much. I can't get the CPA (firm) or the lawyer to address this $659.97 debt much less pay it back. This one is easy to see because it is clearly stated in the beginning of the Estate accounting as a Debt from the Harold O'Connell Trust 659.97. If you review the attached pages 1 through 17 that are part of this Twelfth Account you may notice that:

- The lawyer unilateraly hires the CPA into the Estate (page 1).

- The lawyer will seek my sister's approval to sue me if I don't file the Trust's Seventh Court Account early (page 1). The combined advice of the CPA(firm) and the lawyer force me to file it approximately eighteen months earlier than the Commissioner's scheduled date of October 20, 1993, because I cannnot convince my sister, Jean Nader, that their combined advice is wrong (pages 5,6 and 7). This places the filing of the Trust Account before the filing of the Estate Tax Return that is due on June 15, 1992. This makes it easier to entangle the Trust accounting with the Estate Tax Return accounting and make it appear to my family that the estate was damaged by my management of the Trust.

- The lawyer's letter of April 22, 1992 lists a Debt from the Harold O'Connell Trust 659.97 (page 3) even though I do not sign or submit the Trust's Seventh Court Account that created the $659.97 debt until May 11, 1992 (page 8). The lawyer's letter of May 19, 1992 makes it appear that he doesn’t know what this $659.97 is about and that it is my fault (pages 9 and 10).

- This $659.97 debt is reported to the IRS (page 16 ). But when I ask the lawyer and CPA (firm) about this $659.97 debt they avoid it (page 15), don't know what I'm talking about (text box on page 16), or don't respond (page 17).

Do any of you have the power to compel the CPA (firm) and the lawyer to:

1. Explain why they created this $659.97 debt.

2. Explain why I am made to appear responsible for it.

3. Show exactly where this $ 659.97 debt is now.

4. Pay the $ 659.97 back from the estate to the trust.

5. Do it without inflicting anymore cost and conflict on any member of my family.

I want to keep this simple but you have to understand that the CPA (firm) and the lawyer avoid accountability by using a trusting family member, with no accounting background, such as my sister, Jean Nader, co-executor, to cover for them. Please note the advice that the lawyer expects Jean Nader to rely upon in his letter of April 22, 1992. Jean Nader is innocent and is being used. She does not understand that she is being used. She is not responsible for what the CPA (firm) and the lawyer did. She did not do the accounting. I did not do the accounting. The CPA (firm) and lawyer did the accounting. They will use Jean Nader again and again and again. She has been led to believe that keeping estate accountings a secrect is being loyal to our mother (which makes me appear disloyal). You have to go around Jean Nader to compel the CPA (firm) and the lawyer to be accountable. Please; positively, absolutely, completely, and without exception, do not allow the CPA (firm) and the lawyer to inflict anymore cost and conflict on any member of my family. If you don't have the power to compel the the CPA (firm) and the lawyer to expose and remove the entanglements they created, please understand how I can't.

I would appreciate any effort you might make. Thank you

Trustee to Judges (July, 24, 2000)

Red highlight - The accountants steal money.

Green highlight - The accountants use an innocent family member as cover. The accountant's advice to the innocent family member is designed to render the Testators family powerless by destroying the family as a family. But the innocent family member doesn't know this. The only tool the accountants need is your trust.

2000.07.24 (Anthony

O'Connell

to the Judges of the Nineteenth Circuit Court) (Copy to Joanne Barnes, Edward White, Allison May, Jesse Wilson, Henry Mackall, Peter Arntson,

SEC, IRS, the Virginia Bar, Jean Nader and Sheila O'Connell)

Anthony M. O'Connell. Trustee u/w of H. A. O'Connell

216 Governors Lane, Apt 12,

Harrisonburg, Virginia 22801

July 24, 2000

"The Honorable F. Bruce Bach, Chief Judge

The Honorable J. Howe Brown, Jr.

The Honorable Michael P. McWeeney

The Honorable Marcus D. Williams

The Honorable Gerald Bruce Lee

The Honorable Stanley Paul Klein

The Honorable Robert W. Wooldridge, Jr.

The Honorable Arthur B. Vieregg, Jr.

The Honorable Jane Marum Roush

The Honorable Dennis J. Smith

The Honorable M. Langhorne Keith

The Honorable David T. Stitt

The Honorable Leslie Alden

The Honorable Kathleen H. MacKay

The Honorable Jonathan C. Thacher

Nineteenth Judicial Circuit Court of Virginia

41 10 Chain Bridge Road

Fairfax, Virginia 22030-4009

Ref.:

(1) Trust u/w of H. A. O'Connell, Fiduciary # 21840 (Trust's primary beneficiary is Jean M. O'Connell)

(2) Estate of Jean M. O'Connell, Fiduciary # 49160

(a) Show Cause Against Distribution Order of September 27, 1993

(b) Order of Distribution of October 29, 1993

(c) Exceptions to Commissioners Report of

June 16, 1994, pending (Estate is open)

Summary

A CPA-lawyer fraud operation stole money from the Estate of Jean M. O'Connell. I would like to (1) find out how much money they stole, (2) recover the stolen money, and (3) free the real estate from their controlling accounting entanglements. Because they use an innocent family member to unwittingly carry out their agenda, the traditional paths of justice through the Court won't work. The direct intervention of a Judge is the last hope in the system. If you could (1) protect all the member's of Jean M. O'Connell's family from further damage, and (2) compel a 100% true and complete financial disclosure of her Estate, with one hard copy in my hands, you could expose an otherwise untouchable fraud operation.

The following CPA and lawyer are principals in a sophisticated, entrenched, and so far untouchable fraud operation. Because they both give the same fraudulent advice in secret to an innocent family member to carry out (so that it cannot be traced back to them), I will refer to one or both, and whoever else who conspires with them, as "secret advisors".

Jo Anne Barnes (CPA for the Estate and for the Trust u/w of H.A. O'Connell)

Bruner, Kane & McCarthy, Ltd.

700 North Fairfax

Alexandria, VA 223 13

Edward J. White, Attorney (Co-executor of the Estate)

P.O. Box 207

Kinsale, VA 22488 (Last known address obtained from the Virginia Bar)

They steal money

They stole money, from Jean M. O'Connell's estate. One way was to use two versions of the Estate Tax Return. These are not amendments or corrections, but two different versions with the same dates. There is only supposed to be one Estate Tax Return. They used the innocent family member to sign a $175,000 version with a $175,000 payment, then doctored that $175,000 version to read $119,000, and sent that with a $1 19,000 payment, and not the $175,000 payment, to the IRS.

The basic difference between the $175,000 payment and the $119,000 payment disappeared from their accounting.

Please read the enclosure They Steal Money if you read nothing else. The $175,000 version was exposed because there was a temporary breach in the secrecy by the innocent family member. The secrecy and the setups that render the testator's family helpless do not make sense unless you understand that they are covers for stealing money. If a tax preparer told a client that they needed $ 175,000 to send to the IRS, but the client later found out that the tax preparer only sent $1 19,000 to the IRS, and the whereabouts of the difference was a secret, that means the tax preparer made money disappear. Money is not supposed to disappear. Please understand that they steal money. Please start with this.

Their accountings are the evidence for stealing money. That is why they continue to keep accountings secret. If I could obtain a 100% true and complete financial disclosure of this estate, with one hard copy in my hands, I believe it would show that they stole more than that done with the two versions of the Estate Tax Return, and that they laundered it out of the estate using:

Alison M. May, Stockbroker

A. G. Edwards &Sons, Inc.

524 King Street

Alexandria, VA 22313 (Last known address)

Only a Judge (continued)

Trustee to Judges

(August 23, 2000)

2000.08.23 (Anthony

O'Connell

to the Judges of the Nineteenth Circuit Court) (Copy to Jesse Wilson, Henry Mackall and Peter Arntson)

"The Honorable F. Bruce Bach, Chief Judge

The Honorable Michael P. McWeeney

The Honorable Marcus D. Williams

The Honorable Stanley Paul Klein

The Honorable Robert W. Wooldridge, Jr.

The Honorable Arthur B. Vieregg, Jr.

The Honorable Dennis J. Smith

The Honorable Jane Marum Roush

The Honorable M. Langhorne Keith

The Honorable David T. Stitt

The Honorable Leslie Alden

The Honorable Kathleen H. MacKay

The Honorable Jonathan C. Thacher

The Honorable Henry E. Hudson

The Honorable R. Terrence Ney

Nineteenth Judicial Circuit Court of Virginia

4110 Chain Bridge Road

Fairfax, Virginia 22030-4009

Ref:

(1) My letter to the Judges of July 24, 2000

(2) Commissioner's report of August 8, 2000

The Commissioner's report of August 8, 2000 leads the Nineteenth Judicial Circuit Court to cover-up for a fraud operation. I assume it is being done unwittingly.

For the sake of the public trust, can any of you stop it?

To stop it would require fully exposing and addressing the discrepancies in the accountings of (1) the Estate of Jean M. O'Connell, fiduciary # 49160, and in (2) the accountings of the Trust u/w of H. A. O'Connell, fiduciary # 21840, before these two Accounts are closed.

Respectfully,

Anthony M.

O'Connell

, Trustee u/w of H. A.

O'Connell

Copies to:

Commissioner of Accounts Jesse B. Wilson III

Assistant Commissioner of Accounts Henry C. Mackall

Deputy Commissioner of Accounts Peter A. Arntson"

Trustee to Judges

Exceptions to Commissioner's Report

(August 23, 2000)

2000.08.23 (Anthony

O'Connell

to Judges)

"Exceptions to Commissioner's Report

VIRGINIA: IN THE CIRCUIT COURT OF THE COUNTY OF FAIRFAX

IN RE: Trust u/w of H. A.

O'Connell

To the Honorable Judges of Said Court:

The Honorable F. Bruce Bach, Chief Judge

The Honorable Michael P. McWeeney

The Honorable Marcus D. Williams

The Honorable Stanley Paul Klein

The Honorable Robert W. Wooldridge, Jr.

The Honorable Arthur B. Vieregg, Jr.

The Honorable Dennis J. Smith

The Honorable Jane Marum Roush

The Honorable M. Langhorne Keith

The Honorable David T. Stitt

The Honorable Leslie Alden

The Honorable Kathleen H. MacKay

The Honorable Jonathan C. Thacher

The Honorable Henry E. Hudson

The Honorable R. Terrence Ney

I, Anthony Miner O'Connell, Trustee u/w of H. A. O'Connell, fiduciary # 21840, respectfully excepts to the report of Jesse B. Wilson, III, Commissioner of Accounts, dated August 8,2000, to the Judges of Said Court, and state as my grounds, the following.

1. First, I am not accusing Commissioner of Accounts Jesse B. Wilson, III, or any one else connected with the Court, of any wrongdoing.. I simply do not understand why

Commissioner of Accounts Jesse B. Wilson, III, would want to approve and close

Accounts before the accountings are fully exposed and the discrepancies addressed.

It is against the principals of accounting.

2. Second, the source of the discrepancies are:

Jo Ann Barnes, CPA

Bruner, Kane & McCarthy, Ltd.

700 North Fairfax

Alexandria, VA 22313

Edward White, Attorney

P.O. Box 207

Kinsale, VA 22488

This CPA and lawyer are two principals in the source of the discrepancies that I pointed out in my letter to the Judges of July 24, 2000. The focus should be on the source.

To understand how the CPA and lawyer work would require that the Court fully expose their accountings and compel the CPA and lawyer to address the discrepancies. The CPA-lawyer accountings are the evidence for the discrepancies. I ask that this evidence not be covered up.

3. Third, this report protects the source of the discrepancies, the CPA and the lawyer, rather than the public.

4. Fourth, this report covers up, I assume unwittingly, accountings that have never been exposed and their discrepancies addressed.

5. Fifth, this report, by closing the Account for the Trust u/w of H. A. O'Connell, renders Anthony M. O'Connell, Trustee for the ulw of H. A. O'Connell, helpless.

6. Sixth, this report, by closing the Account for the Trust u/w of H. A. O'Connell, and as explained in the Trust's Twelfth Court Account, renders Anthony M. O'Connell, Trustee for the real estate recorded in B8845 p1444 and B8307 p1446, helpless in the sale of this real estate.

7. Reference "Estate of Harold A. O'Connell, Trust, Fiduciary No. 21840": This may mislead. The Estate of Harold A. O'Connell, fiduciary # 21840, and the Trust u/w of Harold A. O'Connell, fiduciary # 21840, are two separate Court Accounts. Even though they have been assigned the same fiduciary # 21840. My mother, Jean M. O'Connell, who died in 1991, was the fiduciary for the Estate of Harold A. O'Connell. I am the fiduciary for the Trust u/w of Harold A. O'Connell. It is important to not confuse the two Accounts. In 1997 the FBI was apparently led to believe that the Estate of Harold A. O'Connell was the issue when the Trust u/w of Harold O'Connell was the issue. I say this because the FBI sent me copies of accountings from the Estate of Harold A. O'Connell and not copies of accountings from the Trust u/w of H. A. O'Connell. The issue here is not the Estate of Harold A. O'Connell, but the Trust u/w of Harold A. O'Connell.

The office of Chief Judge F. Bruce Bach may have been led to believe that the issue is the Estate of Harold A. O'Connell because their enclosed letter of August 9, 2000 references the "Estate of Harold A. O'Connell". Again, the issue here is not the Estate of Harold A. O'Connell, but the Trust u/w of Harold A. O'Connell. They are two separate Court Accounts. It is important to not confuse the two.

8. Items 1, 2 & 4:

(a) The zero balance in the Trust's Tenth and Eleventh Court Account is not the issue. As explained in the Trust's Twelfth Court Account, the issue is the entanglement of their accounting of the Trust u/w of H. A. O'Connell with their accounting of the Estate of Jean M. O'Connell, and the consequences of these entanglements.

It is difficult to recognize these entanglements and I was not confident enough in the Trust's Tenth and Eleven Court Account to report them. But I knew they were there and that is why I stated that these were not final accounts. As I stated in the Trust Twelfth Court Account to the Commissioner of Accounts: If you don't have the power to compel the the CPA (firm) and the lawyer to expose and remove the entanglements they created, please understand how I can't.

(b) I clearly stated on all the pages of this Eleventh Court Account that 'This is not a Final Account".

(c) Changing the Trust's Eleventh Court Account dated April 24, 1995, to a final

Account, after would eliminate the Trust's Twelfth Court Account. The Twelfth

Court Account is central to this report.

9. I item 4:

(a) To close an account before the discrepancies are resolved violates the principals of accounting.

(b) To close a Court Account against the intent of the person responsible for the

Court Account violates the publics trust.

(c) To close the Account of the Trust u/w of H. A. O'Connell would render me, the Trustee for this Account, helpless.

10. Exceptions to the reports items 5, 7 & 8:

(a) The Twelfth Court Account, as shown on the Commissioner's invoice dated

August 18, 1999, was accepted by the Commissioner on August 8, 1999, and accepted by cashing check # 667 for the filing fee for the Twelfth Account, and accepted by cashing check # 667 for a delinquency fee for the Twelfth Account.

(b) The $659.97 entanglement should not be confusing. The CPA(firm) prepares the

Trust's Seventh Court Account in a manner that requires the Trustee to pay the Estate of Jean M. O'Connell $1,475.97. The lawyer discovers that this is $659.97 too much. But the lawyer will not pay it back to the Trust.

The lawyer reported this $659.97 to the IRS in the Estate Tax Return in 1992, in the first amendment to the Estate Tax Return in 1993, and in the second amendment to the Estate Tax Return in 1995. When something is reported to the IRS it should be treated as real.

(c) The Twelfth Court Account is central to this report. It addresses a discrepancy in the CPA-lawyer accounting. It explains and documents a CPA-lawyer pattern of gaining control of assets, such as real estate, by entangling it in their accounting.

They control the entangled asset to the degree that they control the accounting entanglements they put on it.

In 1992 the CPA(firm) prepared the Trust's Seventh Court Account in a manner that required me to pay the Estate of Jean M. O'Connell $ 1,475.97. The lawyer discovers that this is $659.97 too much. But the lawyer won't pay it back to the Trust. It disappears into ambiguity and confusion. The pattern is that it will be used by the CPA-lawyer later.

There is nothing that I can do to make them pay this $659.97 back to the Trust.

They are in control of this entanglement. They are in control of any asset that they entangle with it. No one makes them accountable for it. This report does not make them accountable for it. They are untouchable. It is that simple.

The rules of accounting require me to carry over the known discrepancies from the Trust's Seventh Account to subsequent Trust Accounts until I can resolve them. One obstacle to exposing the entanglements is that accountings for the Estate of Jean M. O'Connell remain secret. One obstacle to removing them is that I do not have the power to compel the CPA or lawyer to recognize the discrepancies.

I believe the entirety of the Twelfth Court Account should be included for review.

I quote the introduction here:

Anthony M. O'Connell,

Trustee u/w of H. A. O'Connell

216 Governor's Lane Apt I2

Harrisonburg, Virginia 22801

August 9, 1999

Commissioner of Accounts Jesse B. Wilson 111

Deputy Commissioner of Accounts Peter A. Arntson

Fair Oaks Plaza

Suite 500

I1350 Random Hills Road

Fairfax, Virginia 22030

Assistant Commissioner of Accounts Henry C. Mackall

Mackall Mackall Walker & Gibb

4031 Chain Bridge Road

Fairfax, Virginia 22030

Reference:

Trust u/w H. A. O'Connell

Fiduciary Number 21840

Twelfth Account covering the period 1/1/96-12/31/96

A check for $63.00 is enclosed to file this Twelfth Account. This is not a Final [account]

The accounting for the Trust u/w of H. A. O'Connell was entangled with the accounting of the Estate of Jean M. O'Connell, fiduciary # 49160, by the CPA

(firm) I hired and by the lawyer who is co-executor for the Estate:

Ms. Jo Anne Barnes, CPA firm)

Bruner, Kane & McCarthy, Limited

700 North Fairfax

Alexandria, Virginia 22313

Mr. Edward White, Attorney and Co-Executor

P. 0. Box 207

Kinsale, Virginia 22488 (Last known address)

Those who control the entanglements control the people and assets that are entangled. I have experienced the CPA-lawyer entanglements before and know it would be foolhardy to try to sell Accotink (my family's remaining real estate, B8845 p1444 and B8307p1446) until all the entanglements are removed and the accountings are clear.

To keep this Twelth Account simple and clear I will only address one of the known entanglements. In short, the CPA (firm) did the Trust's Seventh Court Account in amanner that required me to pay the Estate $1,475.97. The lawyer discovers that this is $659.97 too much. I can't get the CPA (firm) or the lawyer to address this $659.97debt much less pay it back. This one is easy to see because it is clearly stated in the beginning of the Estate accounting as a Debt from the Harold O'Connell Trust

659.97. If you review the attached pages I through 17 that are part of this Twelfth

Account you may notice that:

- The lawyer unilateraly hires the CPA into the Estate (page I).

- The lawyer will seek my sister's approval to sue me i f I don't file the Trust's Seventh Court Account early (page I). The combined advice of the CPA firm) and the lawyer force me to file it approximately eighteen months earlier than the Commissioner's scheduled date of October 20, 1993, because I cannnot convince my sister, Jean Nader, that their combined advice is wrong (pages 5, 6 and 7). This places the filing of the Trust Account before the filing of the Estate Tax Return that is due on June 15,1992. This makes it easier to entangle the Trust accounting with the Estate Tax Return accounting and make it appear to my family that the estate was damaged by my management of the Trust.

- The lawyer's letter of April 22, 1992 lists a Debt from the Harold O'Connell Trust 659.97 (page 3) even though I do not sign or submit the Trust's Seventh Court Account that created the $659.97 debt until May I I, I992 (page 8). The lawyer's letter of May 19, 1992 makes it appear that he doesn't know what this $659.97 is about and that it is my fault (pages 9 and 10).

- This $659.97 debt is reported to the IRS (page I6 ). But when I ask the lawyer and CPA (firm) about this $659.97 debt they avoid it (page 15,. don't know what I'm talking about (text box on page I6), or don't respond (page 17).

Do any of you have the power to compel the CPA ( firm) and the lawyer to:

I. Explain why they created this $659.97 debt.

2. Explain why I am made to appear responsible for it.

3. Show exactly where this $659.97 debt is now.

4. Pay the $659.97 back from the estate to the trust.

5. Do it without inflicting anymore cost and conflict on any member of my family.

I want to keep this simple but you have to understand that the CPA (firm) and the lawyer avoid accountability by using a trusting family member, with no accounting background, such as my sister, Jean Nader, co-executor, to cover for them Please note the advice that the lawyer expects Jean Nader to rely upon in his letter of April 22,1992. Jean Nader is innocent and is being used. She does not understand that she is being used. She is not responsible for what the CPA (firm) and the lawyer did. She did not do the accounting. I did not do the accounting. The CPA (firm) and lawyer did the accounting. They will use Jean Nader again and again and again. She has been led to believe that keeping estate accountings a secrect is being loyal to our mother (which makes me appear disloyal). You have to go around Jean Nader to compel the (CPA firm) and the lawyer to be accountable. Please; positively, absolutely, completely, and without exception, do not allow the CPA firm) and the lawyer to inflict anymore cost and conflict on any member of my family. Lf you don't have the power to compel the the CPA (firm) and the lawyer to expose and remove the entanglements they created, please understand how I can't.

I would appreciate any effort you might make. Thank you.

Sincerely,

Anthony M. O'Connell,

Trustee u/w of H. A. O'Connell

copy to:

Ms. Jo Anne Barnes, CPA

Mr. Ed White, Attorney and Co-Executor

Ms. Jean Nader, Beneficiary and Co-ExecutorMs. Sheila O'Connell, Beneficiary

This Twelfth Account shows that:

(a) The significance of the $659.97 entanglement is in not the amount of the $659.97, but in it's use, that of a controlling entanglement on real estate: I have experienced the

CPA-lawyer entanglements before and know it would be foolhardy to try to sell Accotink (my family's remaining real estate, B884.5 p1444 and B8307 p1446) until all the entanglements are removed and the accountings are clear. I would not be going through this effort if the significance of the $659.97 was $659.97.The value of these entanglements to the people who created them is reflected in their refusal to address and remove them.

(b) I tried to get the CPA and lawyer to address this $659.97 entanglement for about eight years. They would not address it. The zero balance in my Tenth and Eleventh

Court Account is due to this refusal of the CPA and lawyer to address it. I know there are more entanglements but I can't figure them out because of the secrecy surrounding the Estate of Jean M. O'Connell. The real estate tax entanglement between the Estate and the Trust u/w of H. A. O'Connell is impossible-to unravel.

11. Item 6.

This may imply that the Estate of Jean M. O'Connell is closed: "The Estate of Jean

M. O'Connell, deceased, Fiduciary No. 49160, was closed in the Commissioner of

Accounts office after approval of a Final Account on May 31,1994".

The enclosed copy of a page from the Court's "INDEX TO WILLS & FIDUCIARES: shows that an Exception to the Commissioner's Report for the Estate of Jean M.

O'Connell, fiduciary # 49160, has been on file since June 16, 1994:

... OCONNELL, JEAN M EXCEPTION TO COMM REPORT .... 06/16/94 .. F049160 ..

If this is recognized it means that the Estate of Jean M. O'Connell is not closed.

To the Honorable Judges of the Fairfax County Circuit Court, I beg you to cause a jury to be empaneled to resolve these issues. I ask for a full and complete disclosure of the accountings for the estate of Jean M. O'Connell (which the law says I am entitled to) so I can try to untangle that accounting from the accounting of the Trust u/w of H. A. O'Connell and sell our remaining real estate. I beg the Judges of the Said Court to allow me to do that. The future of the real estate recorded in B8845 p1444 and B8037 p1446 depends on it.

Respectfully submitted this 23rd day of August 2000.

Anthony M. O'Connell, Trustee u/w of H. A. O'Connell

216 Governors Lane Apt 12

Harrisonburg, Virginia 22801

(540) 433-3895

Enclosures, copies of:

(1) Page from the Court's "INDEX TO WILLS & FIDUCIARES: showing that an Exception to the Commissioner's Report for the Estate of Jean M. O'Connell, fiduciary # 49160, has been on file since June 16,1994

(2) Trust's Twelfth Court Account dated August 9, 1999

(3) Checks accepted for Twelfth Court Account

(4) Commissioner Wilson's letter of August 8,2000, Re: Estate of Jean M. O'Connell

(5) Commissioner Wilson's letter of August 8,2000, Re: Trust u/w of H. A. O'Connell, and enclosed Commissioner's Report dated August 8,2000

(6) Letter of August 9, 2000, from the office of Chief Judge A. Bruce Bach"

False

Report to Judges

Why did the Commisioner not show the Judges my actual 12th account?

Instead of his version of my 12th account?

Report

August 8, 2000 - The Commissioner of Accounts Report does not mention his previous approval of the 1,475 - 816 = 659 hook and closes the Trustee's account against the Trustee's will.

"To the Honorable Judges of Said Court:

RE: Estate of Harold A. OConnell, Trust

Fiduciary No. 21840

1. By a Tenth Account duly filed herein and approved by the undersigned on August 25, 1995, the trustee herein, Anthony M. O'Connell, properly accounted for all of the remaining assets reported as being assets of the trust created by the will of Harold OConnell and reported a zero balance on hand. A copy of said account is filed herewith as Exhibit 1.

2. By an Eleventh Account, Anthony M. OConnell, trustee, again reported zero assets on hand and no receipts or disbursements. A copy of said account is filed herewith as Exhibit 2.

3. Both the Tenth and Eleventh accounts carried the notation "This is not a final account".

4. In the ordinary case, an account which shows the distribution of all remaining assets is filed as a Final Account, and its approval terminates the fiduciary's responsibility to the Court and permits the Commissioner of Accounts to close the file.

5. The said trustee has also filed a Twelfth Account in which he reports as an asset $659.97 "due from the Estate of Jean M. OConnell". A copy of that "account" is enclosed herewith as Exhibit 3.

6. The Estate of Jean M. OConnell, deceased, Fiduciary No. 49160, was closed in the Commissioner of Accounts office after approval of a Final Account on May 31, 1994.

7. The said $659.97 was the subject of correspondence between the said trustee and Edward J. White, attorney and co-executor of the estate of Jean M. OConnell, copies of which are attached hereto as Exhibits 4 and 5. In his letter,

Exhibit 5, the trustee explains that the $659.97 is part of a net income payment of $1,475.97 which the trust owed the estate of Jean M. OConnell. In that same letter, the trustee states that "At this point in time, I believe Mr. Balderson and I are of one mind that the estate does not owe the trust and the trust does not owe the estate".

Mr. Balderson was a CPA for the estate. Both of these letters were provided to the Commissioner of Accounts by the trustee in support of his "Twelfth Account".

8. The trustee also provided the Commissioner with a copy of a page from a "Jean M. OConnell estate tax analysis" which shows $659.97 under "Assets" of that estate as "Debt from Harold OConnell Trust". A copy of that page is attached as Exhibits 6.

From a review of this information the Commissioner finds that there is no evidence to support an assertion by the trustee that the $659.97 is an asset of the trust. To the contrary, it appears that either it is not a debt at all, or, from the estate's point of view, it was money owed by the trust to the estate, i.e. an asset of the estate of Jean M. OConnell. That estate has been closed for more that six years.

Accordingly, the foregoing Eleventh Account of Anthony M. OConnell, Trustee has been marked a "Final Account" by the undersigned and is hereby approved as a Final Account in the trust under the will of Harold A. OConnell and is filed herewith.

In the event that the trustee is successful in recovering $659.97 or any other funds which are proper trust assets to be accounted for, such may be reported to the Commissioner of Accounts by an Amended Inventory and, thereafter, accounted for by proper accounts.

GIVEN under my hand this 8th day of August, 2000.

Respectfully submitted,

Jesse B. Wilson, III

Commissioner of Accounts

Fairfax County, Virginia

JBW:jcs

Enc.: Exhibits, 1 - 6

cc: Anthony M. OConnell, Trustee"

Evidence disappeared

Seventeen of my eighteen responses to the Complaint disappeared after being received by the Court on September 25, 2012, at 10:44 am. See number 1:

1 www.chiefjudgesmith.com/evidence/1-545820-23p.pdf

2 www.chiefjudgesmith.com/evidence/2-bk467p191-8p.pdf

3 www.chiefjudgesmith.com/evidence/3-blueprint4p.pdf

4 www.chiefjudgesmith.com/evidence/4-canweconnectthedots2p.pdf

5 www.chiefjudgesmith.com/evidence/5-codeofconduct18p.pdf

6 www.chiefjudgesmith.com/evidence/6-commitments-Individually8p.pdf

7 www.chiefjudgesmith.com/evidence/7-compute-tax-test35p.pdf

8 www.chiefjudgesmith.com/evidence/8-exceptions1994disappeared.pdf

9 www.chiefjudgesmith.com/evidence/9-exceptions2000disappeared.pdf

10 www.chiefjudgesmith.com/evidence/10-overview72p.pdf (Includes complete Deed)

11 www.chiefjudgesmith.com/evidence/11-percentages12p.pdf

12 www.chiefjudgesmith.com/evidence/12-precedence17p.pdf

13 www.chiefjudgesmith.com/evidence/13-tax-records94p.pdf

14 www.chiefjudgesmith.com/evidence/14-trust-deed-invisible175p.pdf (Includes complete Deed)

15 www.chiefjudgesmith.com/evidence/15-trust-documents42p.pdf (Includes complete Deed)

16 www.chiefjudgesmith.com/evidence/16-unknown14p.pdf (Includes first 3 pages of Deed)

17 www.chiefjudgesmith.com/evidence/17-usingIRS15p.p

www.chiefjudgesmith.com/evidence/all-18responses714p.pdf (Includes multile copies of Deed)

Complaint - www.chiefjudgesmith.com/evidence/complaint60p.pdf

My responses - www.chiefjudgesmith.com/evidence/all18responses714p.pdf

My email verifying 18 responses - www.chiefjudgesmith.com/evidence/email-verifying18responses3p.pdf

Order - www.chiefjudgesmith.com/evidence/order5p.pdf

Those who don't want the accounting expose want me out because I have experience in accounting and try to expose theirs. They want our sister Jean Nader in because they can use her to unwittingly carry out their agenda.

Insert links.to 17

INSERT COMPLAINT ITEMS 28-31 (quotes)

?Go into the 11th account? INSERT LINKS TO 11th

12th actual

Link

Believe it or not, the only protection the public has is for every member of the family learn to recognize the fraud patterns before it's too late. There is nothing you can do to stop them if one member of your family trusts them. They are ruthless. They are above the law.

If a just power doesn't stop them from using our innocent sister (Last known address: Jean O'Connell Nader, 444 Summit Street, New Kensington, Pennsylvania, 15068 Telephone 724 337-7537) to unwittingly carryout their agenda, they will continue to use her until it kills me.

The most difficult barrier for me in recognizing the patterns is to overcome my "Oh-no-they-wouldn't-do-that-much-less-get-away-with-it mindset. They will do that and they will get away with it. What couldn't a Chief Judge frame me with when he can frame me with this Complaint and Order? When my exposing the accounting hook 1,475 -816 = 659 is spun to justify removing me as Trusttee? Is there is a son or daughter of Virginia who will stand up for the rule of law against these powers?

I have been setup and character assassinated for thirty-one years. Their accountings remain concealed. I've lost most everything. After thirty-one years I believe it is fair to say the government will continue to protect the fraudsters instead of the public. The remaining hope is the media. The only reason I can think of for the media to not tell the public is the same reason the media hesitated to print the pentagon papers; that they would be sued for libel. I pray the press would not self censor. The institutional sordidness reminds me of the Dreyfus Affair. I believe Emile Zola's newspaper article "J'accuse" (I accuse) defending Alfred Dreyfus made him an enemy of the State.

JMO/JON  AMO AMO

The walls of secrecy are impenetrable.

JMO - Jean Miner O'Connell, Mother

JON - Jean O'Connell Nader, daughter

AMO - Anthony Miner O'Connell, son

Hooks

1,475 - 816 = 659

Learn to recogize hooks

The pattern the fraudsters most don't want recognized is their planting of hooks. Who ever controls the hooks (the accountants) controls the people and assets that are hooked or entangled. Hooks render the family powerless.

Your trust is a hook. Withholding what you need is a hook. Withholding the final account for our Dad's estate is a hook. Ignoring my Deed as Trustee and never saying why is a hook. It blocked me from selling the Trust property and forced me to pay the real estate taxes until I ran out of money. My two Exceptions to the Commissioner's Reports disappearing after being received by the Court is a hook. Seventeen of my eighteen responses to the Complaint used to remove me as Trustee disappearing after being received by the Court is a hook.

It is uncanny how well the simple 1,475 - 816 = 659 hook illustrates the dynamics. One indicator of it's significance is the degree those in control go to make it appear insignificant. Small numbers are used to make it appear unworthy of attention. As if the issue were the amount. The issue is not the amount. The issue is that they entangle.

Debt fm Harold O'Connell Trust ........ 659.97

The 1,475-816=659 hook

The only why to recognize accounting fraud is to expose the accounting trails. It is necessary to differentiate between what people say and what the accounting trails say. Such as "Debt fm Harold O'Connell Trust ..... 659.97" and:

"Int fm Harold O'Connell Trust ......................................... 816.00" (Estate accounting at bk467p192)

"Debt fm Harold O’Connell Trust ...................................... 659.97" (Estate accounting at bk467p192)

"Payable to the Estate of Jean M. O'Connell ... ... .... ... $ 1,475.97" (Trust accounting at bk480p1768)

(Commissioner of Accounts Jesse B. Wilson, III, approved these accounting trails. And then closed my Trust account against my intent after I recognized the accounting trail.

&&&&&&&&&&&&&&&&&&&&&&&&&&&&& Start True or False &&&&&&&&&&&&&&&&&&

True or false?

True

1999.08.09 Anthony O'Connell to Jesse Wilson and Henry Mackall

(The Trust's Twelfth Court Account, covering the period from 1996.1.1 to 1996.12.31)

"A check for $63.00 is enclosed to file this Twelfth Account. This is not a Final Account.

The accounting for the Trust u/w of H. A. O'Connell was entangled with the accounting of the Estate of Jean M. O'Connell, fiduciary # 49160, by the CPA (firm) I hired and by the lawyer who is co-executor for the Estate:

Ms. Jo Anne Barnes, CPA (firm).

Bruner, Kane & McCarthy, Limited

700 North Fairfax

Alexandria, Virginia 22313

Mr. Edward White, Attorney and Co-Executor

P.0. Box 207

Kinsale, Virginia 22488 (Last known address)

Those who control the entanglements control the people and assets that are entangled. I have experienced the CPA-lawyer entanglements before and know it would be foolhardy to try to sell Accotink (my family's remaining real estate, B8845 p1444 and B8307 p1446) until all the entanglements are removed and the accountings are clear.

To keep this Twelth Account simple and clear I will only address one of the known entanglements. In short, the CPA (firm) did the Trust's Seventh Court Account in a manner that required me to pay the Estate $ 1,475.97. The lawyer discovers that this is $659.97 too much. I can't get the CPA (firm) or the lawyer to address this $659.97 debt much less pay it back. This one is easy to see because it is clearly stated in the beginning of the Estate accounting as a Debt from the Harold O'Connell Trust 659.97. If you review the attached pages 1 through 17 that are part of this Twelfth Account you may notice that:

- The lawyer unilateraly hires the CPA into the Estate (page 1).

- The lawyer will seek my sister's approval to sue me if I don't file the Trust's Seventh Court Account early (page 1). The combined advice of the CPA(firm) and the lawyer force me to file it approximately eighteen months earlier than the Commissioner's scheduled date of October 20, 1993, because I cannnot convince my sister, Jean Nader, that their combined advice is wrong (pages 5,6 and 7). This places the filing of the Trust Account before the filing of the Estate Tax Return that is due on June 15, 1992. This makes it easier to entangle the Trust accounting with the Estate Tax Return accounting and make it appear to my family that the estate was damaged by my management of the Trust.

- The lawyer's letter of April 22, 1992 lists a Debt from the Harold O'Connell Trust 659.97 (page 3) even though I do not sign or submit the Trust's Seventh Court Account that created the $659.97 debt until May 11, 1992 (page 8). The lawyer's letter of May 19, 1992 makes it appear that he doesn’t know what this $659.97 is about and that it is my fault (pages 9 and 10).

- This $659.97 debt is reported to the IRS (page 16 ). But when I ask the lawyer and CPA (firm) about this $659.97 debt they avoid it (page 15), don't know what I'm talking about (text box on page 16), or don't respond (page 17).

Do any of you have the power to compel the CPA (firm) and the lawyer to:

1. Explain why they created this $659.97 debt.

2. Explain why I am made to appear responsible for it.

3. Show exactly where this $ 659.97 debt is now.

4. Pay the $ 659.97 back from the estate to the trust.

5. Do it without inflicting anymore cost and conflict on any member of my family.

I want to keep this simple but you have to understand that the CPA (firm) and the lawyer avoid accountability by using a trusting family member, with no accounting background, such as my sister, Jean Nader, co-executor, to cover for them. Please note the advice that the lawyer expects Jean Nader to rely upon in his letter of April 22, 1992. Jean Nader is innocent and is being used. She does not understand that she is being used. She is not responsible for what the CPA (firm) and the lawyer did. She did not do the accounting. I did not do the accounting. The CPA (firm) and lawyer did the accounting. They will use Jean Nader again and again and again. She has been led to believe that keeping estate accountings a secrect is being loyal to our mother (which makes me appear disloyal). You have to go around Jean Nader to compel the CPA (firm) and the lawyer to be accountable. Please; positively, absolutely, completely, and without exception, do not allow the CPA (firm) and the lawyer to inflict anymore cost and conflict on any member of my family. If you don't have the power to compel the the CPA (firm) and the lawyer to expose and remove the entanglements they created, please understand how I can't.

I would appreciate any effort you might make. Thank you

The 12th and 13th interim trust accounts had been declared delinquent. Delinquency fees and recording fees for the 12th court account were paid and accepted.

I filed an Exception to the Commissioner's Report of August 8, 2000. My Exceptions disappeared after being received by the Court on August 23, 2000:

Seventeen of my eighteen responses to the Complaint against me disappeared after being received by the Court on September 25, 2012, at 10:44 am:

1 www.chiefjudgesmith.com/evidence/1-545820-23p.pdf

2 www.chiefjudgesmith.com/evidence/2-bk467p191-8p.pdf

3 www.chiefjudgesmith.com/evidence/3-blueprint4p.pdf

4 www.chiefjudgesmith.com/evidence/4-canweconnectthedots2p.pdf

5 www.chiefjudgesmith.com/evidence/5-codeofconduct18p.pdf

6 www.chiefjudgesmith.com/evidence/6-commitments-Individually8p.pdf

7 www.chiefjudgesmith.com/evidence/7-compute-tax-test35p.pdf

8 www.chiefjudgesmith.com/evidence/8-exceptions1994disappeared.pdf

9 www.chiefjudgesmith.com/evidence/9-exceptions2000disappeared.pdf

10 www.chiefjudgesmith.com/evidence/10-overview72p.pdf (Includes complete Deed)

11 www.chiefjudgesmith.com/evidence/11-percentages12p.pdf

12 www.chiefjudgesmith.com/evidence/12-precedence17p.pdf

13 www.chiefjudgesmith.com/evidence/13-tax-records94p.pdf

14 www.chiefjudgesmith.com/evidence/14-trust-deed-invisible175p.pdf (Includes complete Deed)

15 www.chiefjudgesmith.com/evidence/15-trust-documents42p.pdf (Includes complete Deed)

16 www.chiefjudgesmith.com/evidence/16-unknown14p.pdf (Includes first 3 pages of Deed)

17 www.chiefjudgesmith.com/evidence/17-usingIRS15p.p

www.chiefjudgesmith.com/evidence/all-18responses714p.pdf (Includes multile copies of Deed)

Complaint - www.chiefjudgesmith.com/evidence/complaint60p.pdf

My responses - www.chiefjudgesmith.com/evidence/all18responses714p.pdf

My email verifying 18 responses - www.chiefjudgesmith.com/evidence/email-verifying18responses3p.pdf

Order - www.chiefjudgesmith.com/evidence/order5p.pdf

False

Report

August 8, 2000 - The Commissioner of Accounts Report does not mention his previous approval of the 1,475 - 816 = 659 hook and closes the Trustee's account against the Trustee's will.

"To the Honorable Judges of Said Court:

RE: Estate of Harold A. OConnell, Trust

Fiduciary No. 21840

1. By a Tenth Account duly filed herein and approved by the undersigned on August 25, 1995, the trustee herein, Anthony M. O'Connell, properly accounted for all of the remaining assets reported as being assets of the trust created by the will of Harold OConnell and reported a zero balance on hand. A copy of said account is filed herewith as Exhibit 1.

2. By an Eleventh Account, Anthony M. OConnell, trustee, again reported zero assets on hand and no receipts or disbursements. A copy of said account is filed herewith as Exhibit 2.

3. Both the Tenth and Eleventh accounts carried the notation "This is not a final account".

4. In the ordinary case, an account which shows the distribution of all remaining assets is filed as a Final Account, and its approval terminates the fiduciary's responsibility to the Court and permits the Commissioner of Accounts to close the file.

5. The said trustee has also filed a Twelfth Account in which he reports as an asset $659.97 "due from the Estate of Jean M. OConnell". A copy of that "account" is enclosed herewith as Exhibit 3.

6. The Estate of Jean M. OConnell, deceased, Fiduciary No. 49160, was closed in the Commissioner of Accounts office after approval of a Final Account on May 31, 1994.

7. The said $659.97 was the subject of correspondence between the said trustee and Edward J. White, attorney and co-executor of the estate of Jean M. OConnell, copies of which are attached hereto as Exhibits 4 and 5. In his letter,

Exhibit 5, the trustee explains that the $659.97 is part of a net income payment of $1,475.97 which the trust owed the estate of Jean M. OConnell. In that same letter, the trustee states that "At this point in time, I believe Mr. Balderson and I are of one mind that the estate does not owe the trust and the trust does not owe the estate".

Mr. Balderson was a CPA for the estate. Both of these letters were provided to the Commissioner of Accounts by the trustee in support of his "Twelfth Account".

8. The trustee also provided the Commissioner with a copy of a page from a "Jean M. OConnell estate tax analysis" which shows $659.97 under "Assets" of that estate as "Debt from Harold OConnell Trust". A copy of that page is attached as Exhibits 6.

From a review of this information the Commissioner finds that there is no evidence to support an assertion by the trustee that the $659.97 is an asset of the trust. To the contrary, it appears that either it is not a debt at all, or, from the estate's point of view, it was money owed by the trust to the estate, i.e. an asset of the estate of Jean M. OConnell. That estate has been closed for more that six years.

Accordingly, the foregoing Eleventh Account of Anthony M. OConnell, Trustee has been marked a "Final Account" by the undersigned and is hereby approved as a Final Account in the trust under the will of Harold A. OConnell and is filed herewith.

In the event that the trustee is successful in recovering $659.97 or any other funds which are proper trust assets to be accounted for, such may be reported to the Commissioner of Accounts by an Amended Inventory and, thereafter, accounted for by proper accounts.

GIVEN under my hand this 8th day of August, 2000.

Respectfully submitted,

Jesse B. Wilson, III

Commissioner of Accounts

Fairfax County, Virginia

JBW:jcs

Enc.: Exhibits, 1 - 6

cc: Anthony M. OConnell, Trustee"

Complaint (See items 29-33)

COMES NOW the Plaintiff, Jean Mary O'Connell Nader, by counsel, and brings this

action pursuant to § 26-48 and 55-547.06 of the Code of Virginia (1950, as amended) for the removal and appointment of a trustee, and in support thereof states the following.

Parties and Jurisdiction

1. Plaintiff Jean Mary O’Connell Nader ("Jean") and *Defendants Anthony Miner

O’Connell ("Anthony") and Sheila Ann O'Connell ("Sheila") are the children of Harold A. O’Connell ("Mr. O’Connell"), who died in 1975, and Jean M. O'Connell ("Mrs. O'Connell"), who died on September 15, 1991.

2. The trusts that are the subject of this action are: (a) the trust created under the Last Will and Testament of Harold A. O'Connell dated April 11, 1974, and admitted to probate in this Court on June 18, 1975; and (b) a Land Trust Agreement dated October 16, 1992, which was recorded among the land records of this Court in Deed Book 8845 at Page 1449.

3. Jean, Sheila, and Anthony are the beneficiaries of both of the trusts and, therefore, are the parties interested in this proceeding.

Facts

4. During their lifetimes, Mr. and Mrs. O'Connell owned as *tenants in common a

parcel of unimproved real estate identified by Tax Map No. 0904-0 1-00 17 and located near the Franconia area of Fairfax County, Virginia and consisting of approximately 15 acres (the "Property").

5. After his death in 1975, a 46.0994% interest in the Property deriving fiom Mr,

O'Connell's original 50% share was transferred to a trust created under his Last Will and Testament (the "Harold Trust"), of which Anthony serves as trustee. A copy of the Last Will and Testament of Harold A. O'Connell is attached hereto as Exhibit A.

6. Mrs. O'Connell held a life interest in the Harold Trust and, upon her death in

1991, the trust assets were to be distributed in equal shares to Jean, Sheila, and Anthony as remainder beneficiaries. Although other assets of the Harold Trust were distributed to the remainder beneficiaries, the trust's 46.0994% interest in the Property has never been distributed to Jean, Sheila, and Anthony in accordance with the terms of the Harold Trust.

7. After Mrs. O'Connell's death, her 53.9006% interest in the Property passed to

Jean, Sheila, and Anthony in equal shares, pursuant to the terms of her Last Will and Testament and Codicil thereto, which was admitted to probate in this Court on December 10, 1991.

8. Thus, after Mrs. O'Connell's death, Jean, Sheila, and Anthony each owned a

17.96687% interest in the Property, and the Harold Trust continued to own a 49.0994% interest in the Property.

9. By a Land Trust Agreement dated October 16, 1992, Jean, Sheila, and Anthony,

individually and in his capacity as trustee of the Harold Trust, created a Land Trust (the "Land Trust"), naming Anthony as initial trustee. A copy of the Land Trust Agreement is attached hereto as Exhibit B and incorporated by reference herein. The Harold Trust, Jean, Sheila, and Anthony (individually) are the beneficiaries of the Land Trust.

10. The Property was thereafter conveyed by Jean, Sheila, and Anthony, individually

and as trustee of the Harold Trust, to Anthony, as trustee of the Land Trust, by a Deed dated October 16,1992 and recorded on October 23,1992 in Deed Book 8307 at Page 1446 among the land records for Fairfax County.

11. As trustee under the Land Trust, Anthony was granted broad powers and

responsibilities in connection with the Property, including the authority and obligation to sell the Property. Paragraph 4.04 of the Land Trust Agreement states, in part, as follows:

If the Property or any part thereof remains in this trust at the expiration of twenty (20) years from date hereof, the Trustee shall promptly sell the Property at a public sale after a reasonable public advertisement and reasonable notice thereof to the Beneficiaries.

12. To date, the Property has not been sold, and the Land Trust is due to expire on

October 16,2012.

13. According to Paragraph 9.03 of the Land Trust Agreement, the responsibility for

payment of all real estate taxes on the Property is to be shared proportionately by the

beneficiaries. However, if a beneficiary does not pay his or her share, the Land Trust Agreement provides:

The Trustee will pay the shortfall and shall be reimbursed the principal plus 10% interest per annum. Trustee shall be reimbursed for any outstanding real estate tax shares or other Beneficiary shared expense still owed by any Beneficiary at settlement on the eventual sale of the property.

14. For many years, Jean sent payment to Anthony for her share of the real estate

taxes on the Property. Beginning in or about 1999, Anthony refused to accept her checks because they were made payable to "County of Fairfax." Anthony insisted that any checks for the real estat'k taxes be made payable to him individually, and he has returned or refused to forward Jean's checks to Fairfax County. Under the circumstances, Jean is unwilling to comply with Anthony's demands regarding the tax payments.

15. Anthony is not willing or has determined he is unable to sell the Property due to a

mistaken interpretation of events and transactions concerning the Property and, upon information and belief, the administration of his mother's estate. Anthony's position remains intractable, despite court rulings against him, professional advice, and independent evidence. As a result, Anthony is unable to effectively deal with third parties and the other beneficiaries of the Land Trust.

16. In 2007, Anthony received a reasonable offer from a potential buyer to purchase

the Property. Upon information and belief, Anthony became convinced of a title defect with the Property that, in his opinion, was an impediment to the sale of the Property. A title commitment issued by Stewart Title and Escrow on April 24,2007, attached hereto as Exhibit C, did not persuade Anthony that he, as the trustee of the Land Trust, had the power to convey the Property. Because of this and other difficulties created by Anthony, the Property was not sold.

17. Since 2007, it appears the only effort put forth by Anthony to sell the Property has

been to post it for sale on a website he created, http://www.alexandriavirginial5acres.com

18. Since 2009, Anthony has failed to pay the real estate taxes for the Property as

required by the Lhd Trust Agreement. Currently, the amount of real estate tax owed, including interest and penalties, is approximately $27,738.00.

19. Anthony has stated that he purposely did not pay the real estate taxes in order to

force a sale of the Property and clear up the alleged title defects.

20. Since the real estate taxes are more than two years delinquent, Anthony's failure

to pay may result in a tax sale of the Property. Anthony was notified of this possibility by a notice dated October 26, 201 1, attached hereto as Exhibit D. In addition to the threatened tax sale, the Land Trust is incurring additional costs, including penalties, interest, and fees, that would not be owed if Anthony had paid the real estate taxes in a timely manner.

21. In May 20 12, Jean, through her counsel, wrote a letter to Anthony requesting that

he cooperate with a plan to sell the Property or resign as trustee. To date, Anthony has not expressed a willingness to do either, and still maintains that the alleged title defect and other "entanglements" must be resolved before any action can be taken towards a sale of the Property.

Count I: Removal of Anthony O'Connell as Trustee of Land Trust

22: The allegations of paragraphs 1 through 21 are incorporated by reference as if

fully stated herein.

23. As trustee of the Land Trust, Anthony has a fiduciary duty to comply with the

terms of the trust agreement, to preserve and protect the trust assets, and to exercise reasonable care, skill, and caution in the administration of the trust assets.

24. Anthony has breached his fiduciary duties by his unreasonable, misguided, and imprudent actions, including but not limited to, his failure to sell the Property and non-payment of the real estate taxes on the Property.

25. The breaches of duty by Anthony constitute good cause for his removal as trustee

of the Land Trust.

WHEREFORE, Plaintiff Jean Mary O'Connell Nader prays for the following relief:

A. That the Court remove Anthony Minor O'Connell as trustee under the Land Trust

Agreement dated October 16, 1992, pursuant to 26-48 of the Code of Virginia

(1950, as amended);

B. That all fees payable to Anthony Minor O'Connell under the terms of the

aforesaid Land Trust Agreement, including but not limited to, the trustee's

compensation under paragraph 9.01, and all interest on advancements by the

trustee to the trust for payment of real estate taxes pursuant to paragraph 9.03, be

disallowed and deemed forfeited;

C. That all costs incurred by Plaintiff Jean Mary O'Connell Nader in this action,

including reasonable attorneys' fees, be paid by the Land Trust; and

D. For all such further relief as this Court deems reasonable and proper.

Count 11: Removal of Anthony O'Connell as Trustee of the Trust under the Will of Harold A. O'Connell

26. The allegations of paragraphs 1 through 25 are incorporated by reference as if

fully stated herein.

27. The terms of the Harold Trust provide that, upon the death of Mrs. O'Connell, the

assets are to be distributed to Jean, Sheila, and Anthony in equal shares. Notwithstanding the terms of the Harold Trust and the provisions for its termination, Anthony entered into the Land

Trust Agreement in his capacity as trustee of the Harold Trust. As a result, upon the sale of the

Property, Anthony can exercise greater control over the Harold Trust's share of the sale proceeds

than if the parties held their beneficial interests in their individual capacities.

28, Other than its status as beneficiary of the Land Trust, there is no reason for the

continuation of the Harold Trust.

29. On August 8, 2000, an Eleventh Account for the Harold Trust was approved by the Commissioner of Accounts for the Circuit Court of Fairfax County and determined to be a final account.

30. Anthony repeatedly and unsuccessfully challenged the Commissioner's determination and requested, inter alia, that the Court and the Commissioner of Accounts investigate a debt of $659.97 that he alleged was owed to the Harold Trust by Mrs. O'Connell's estate. In these proceedings, the Commissioner stated, and the court agreed, that there was no evidence to support Anthony's claims that a debt existed and, if so, that it was an asset of the Harold Trust.

31. Anthony's repeated and unsuccessful challenges to the rulings of the

Commissioner of Accounts and the Circuit Court in connection with the Eleventh Account, and his persistence in pursuing his unfounded claims to the present day, demonstrate that he is unable to administer the Harold Trust effectively and reliably.

32. It is in the best interests of the beneficiaries of the Harold Trust that, upon the sale

of the Property, the net sale proceeds be distributed in an orderly and expedient manner. Based on Anthony's actions, he is not the proper individual to fulfill the trustee's duties in administering the Harold Trust.

33. The removal of Anthony as trustee best serves the interests of the beneficiaries of the Harold Trust.

WHEREFORE, Plaintiff Jean Mary O'Connell Nader prays for the following relief:

A. That the Court remove Anthony Minor O'Connell as trustee under the Last Will

and Testament of Harold A. O'Connell, pursuant to § 55-547.06 of the Code of

Virginia (1 950, as amended);

B. That all costs incurred by Plaintiff Jean Mary O'Comell Nader in this action

including reasonable attorneys' fees, be awarded to her in accordance with § 55- 550.04 of the Code of Virginia (1950, as amended); and

C. For all such further relief as this Court deems reasonable and proper.

Count 111: Appointment of Successor Trustee

34. The allegations of paragraphs 1 through 33 are incorporated by reference as if

fully stated herein.

35. Jean is a proper person to serve as trustee of the Land Trust in order to sell the

Property on behalf of the beneficiaries of the Land Trust, and she is willing and able to serve in such capacity.

36. The best interests of the beneficiaries would be served if the Land Trust is continued for a sufficient period of time to allow the successor trustee to sell the Property, rather than allowing the Land Trust to terminate on the date specified in the Land Trust Agreement. Each of the individual beneficiaries of the Land Trust is age 70 or above, and it would be prudent to sell the Property during their lifetimes, if possible, rather than leaving the matter for the next generation to resolve.

37. Jean is a proper person to serve as trustee of the trust created under the Last Will

and Testament of Harold A. O'Connell, and she is willing and able to serve in such capacity.

WHEREFORE, Plaintiff Jean Mary O'Connell Nader prays for the following relief:

A. That Plaintiff Jean Mary O'Connell Nader be appointed as successor trustee under

the aforesaid Land Trust Agreement, with the direction to sell the Property upon

such terms and conditions as this Court deems reasonable and appropriate,

including, but not limited to, fixing a reasonable amount as compensation of the

successor trustee for her services;

B. That the term of the Land Trust be continued for a reasonable time in order to

allow for the sale of the Property;

C. That Plaintiff Jean Mary O'Connell Nader be appointed as successor trustee under

the Last Will and Testament of Harold A. O'Connell for all purposes, including

distribution of the net proceeds of the sale of the Property that are payable to such

trust;

D. That all costs incurred by Plaintiff Jean Mary O'Connell Nader in this action,

including reasonable attorneys' fees, be paid by the Land Trust; and

E. For all such further relief as this Court deems reasonable and proper.

&&&&&&&&&&&&&&&&&&& End of True or False &&&&&&&&&&&&&&&&&&&&&&

Seventeen of my eighteen responses to the Complaint dissappeared

after being received by the Court on September 25, 2012 at 10:44am

VIRGINIA:

IN THE CIRCUIT COURT OF FAIRFAX COUNTY

JEAN MARY O'CONNELL NADER, Plantiff

v